P2P Lending Platform Website Design Service

We build secure, user-friendly, and compliant P2P lending websites. Our expert designs help you connect borrowers and lenders, manage loans, and grow your fintech platform.

Trusted by leading fintech startups & P2P lenders worldwide.

Introduction

Secure P2P Lending Platforms that build trust, engage users, and drive investments.

Our fintech design experts build custom peer-to-peer lending platforms. We create intuitive dashboards, secure transaction flows, and automated loan management systems. We ensure your site is scalable, compliant, and ready to launch in the competitive fintech market.

Security

Compliance

Scalability

Our Capabilities

- Custom User Dashboards

- Loan Management Systems

- Secure Payment Integration

- Automated Credit Scoring

- Regulatory Compliance

- Risk Assessment Tools

- P2P Platform Redesign

Benefits

Why Choose Qrolic for P2P Lending Platform Design?

We build secure, compliant, and user-friendly P2P lending platforms that build trust and drive growth. Discover why we’re the experts in fintech web design.

Fintech Industry Focus

Our designers specialize in fintech, creating P2P lending platforms that are intuitive for both borrowers and investors.

Secure & Compliant

We prioritize security and regulatory compliance, building platforms with robust data protection and transaction security features.

Investor & Borrower Portals

We develop custom, easy-to-use dashboards for investors to manage portfolios and for borrowers to track their loans.

Scalable Architecture

Our P2P platforms are built on scalable technology, ready to grow with your user base and transaction volume.

Seamless User Experience

We design a frictionless journey from registration to loan funding, enhancing user trust and platform credibility.

Expert Project Management

Our experienced team ensures your P2P lending website project is delivered on time, on budget, and to your exact specifications.

Ready to Launch Your P2P Lending Platform?

Get a Free Consultation

Have an idea for a P2P platform? Let our experts guide you through the technical and design requirements.

P2P Platform Design Process

Our Expert P2P Lending

Platform Design Process

We build secure, compliant, and user-friendly P2P lending platforms that connect borrowers and investors seamlessly.

Comparison

Not All P2P Lending Platform Designs Are Created Equal

Does your platform inspire trust or create friction for users?

Here’s how generic design fails fintech, and how our specialized approach succeeds.

Other Services

Without Qrolic :

- Uses generic, non-specialized templates

- Lacks secure investor & borrower portals

- Ignores critical compliance features

- Complicated user onboarding flows

- Slow transaction processing

- Weak security features erode user trust

- Poor integration with financial APIs

- No specialized support for fintech

Qrolic Technologies

With Qrolic :

- Custom design for your P2P lending model

- Secure dashboards for investors & borrowers

- Designed with regulatory compliance in mind

- Streamlined, intuitive user journeys

- Fast, reliable performance for transactions

- Strong security and trust-building elements

- Seamless payment gateway integration

- Support from experienced fintech experts

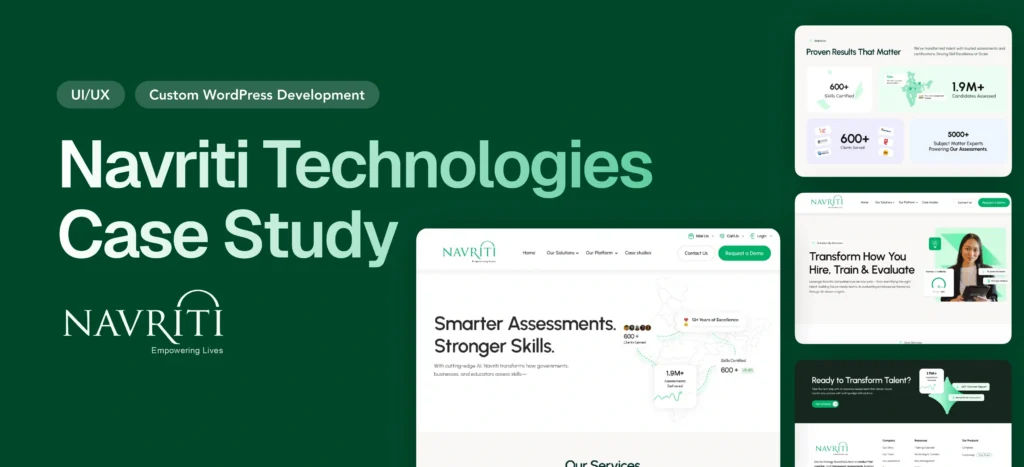

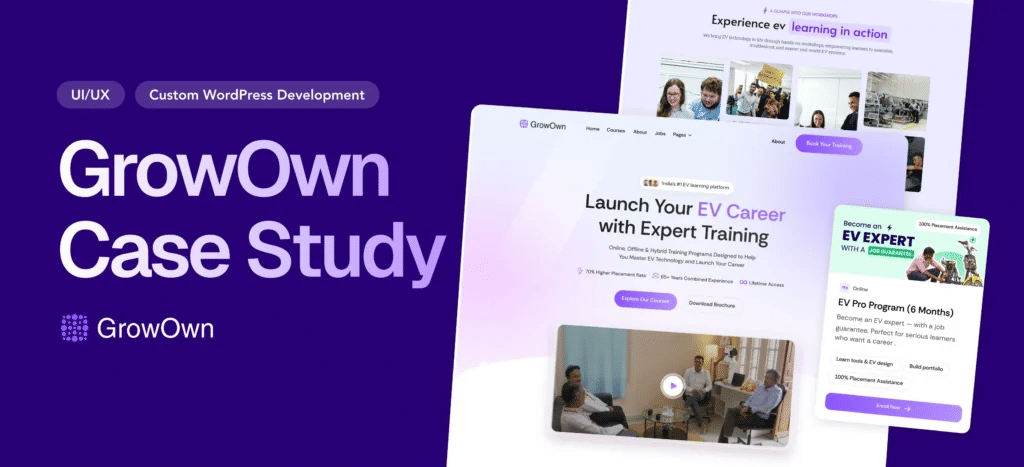

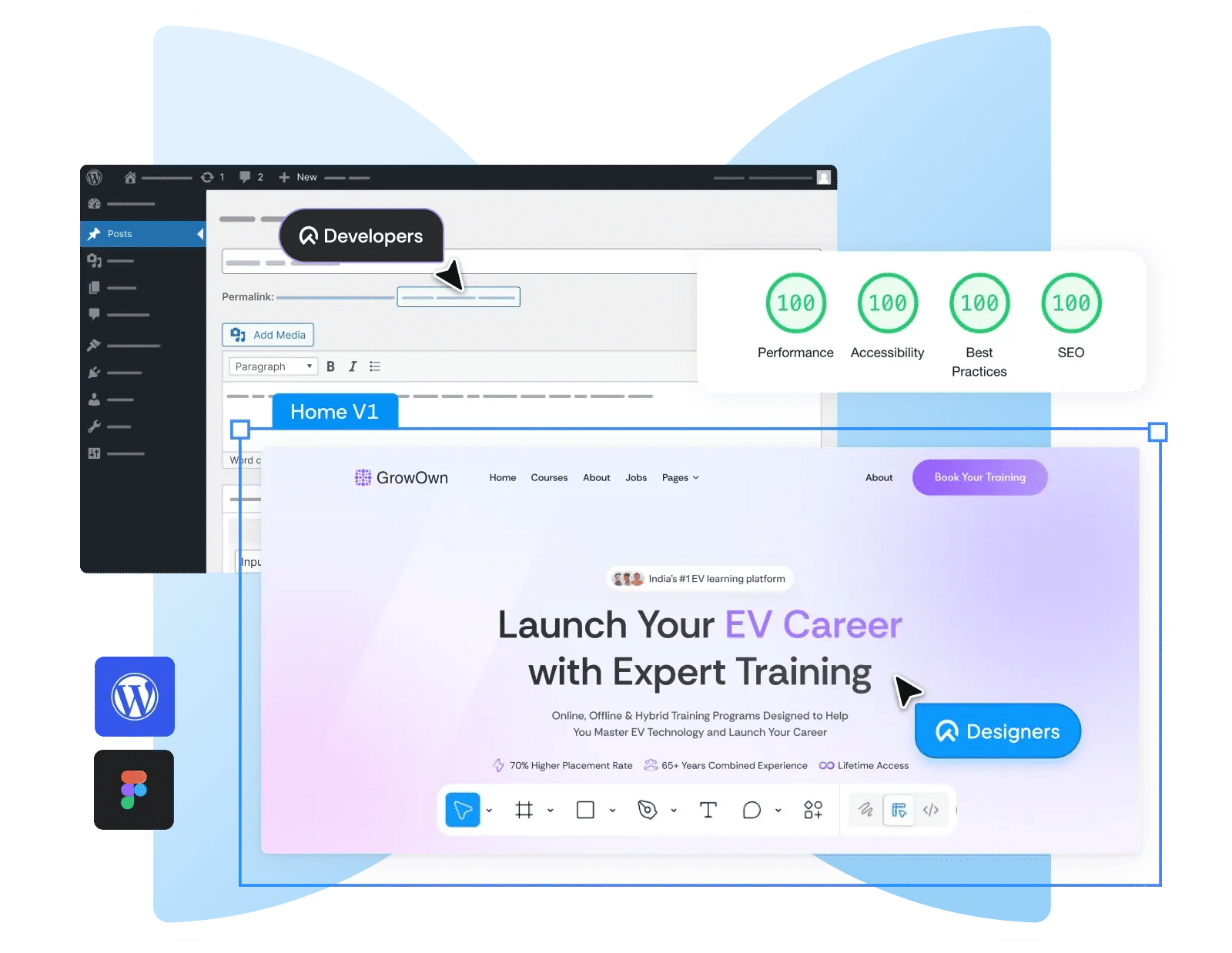

Case Studies

Proven Success in

Fintech Design

See how our P2P lending platform designs have helped clients boost user acquisition, build investor trust, and scale their operations.

Why Qrolic

Your Expert Partner for P2P Lending Platforms

Our fintech design experts deliver secure, compliant, and user-friendly P2P lending websites. We build platforms that foster trust and drive growth.

0+

Years of WordPress

Delivering top-tier digital services across design, development, and performance.

0+

Happy Clients

Serving global brands with a 95%+ satisfaction rate across industries.

0%

Client satisfaction

We’re committed to delivering solutions that truly make an impact.

0+

Team members

A strong team of experts in WordPress, web technologies, and UI/UX.

Build Your P2P Lending Platform?

Expert P2P Lending Platform Design – Build Trust & Drive Growth

Get a free consultation and discover how our expert P2P lending platform design services can create a secure, user-friendly, and compliant platform that connects borrowers and lenders effectively.

Curious About the Cost? Free

Just drop your requirements on WhatsApp, and we’ll send you an instant estimate—no forms, no waiting.

Curious About the Cost? Free

Just drop your requirements on WhatsApp, and we’ll send you an instant estimate—no forms, no waiting.

Frequently Asked Questions

P2P Lending Website Design FAQs

Our expert designers build secure, high-performance P2P lending platforms. We focus on creating user-friendly interfaces that build trust and drive loan activity.

What is included in your P2P lending platform design service?

We offer end-to-end design for P2P lending websites, including borrower and lender dashboards, loan application forms, investment portals, and secure admin panels. Our goal is a fully functional and intuitive platform.

What technology stack do you use for P2P platform development?

We build custom P2P lending platforms using robust technologies like React, Node.js, and secure databases. We choose the best tech stack to ensure your platform is scalable, secure, and fast.

How long does it take to design and launch a P2P lending website?

A standard P2P lending platform design takes about 8-16 weeks, depending on the complexity of features like credit scoring models and payment gateway integrations. We provide a detailed project timeline after our initial consultation.

Is the P2P lending platform design mobile-friendly?

Absolutely. We create a fully responsive design, ensuring a seamless experience for both borrowers and lenders on desktops, tablets, and smartphones. Mobile accessibility is key in the fintech space.

How do you ensure the platform attracts borrowers and investors?

We build our P2P platforms with SEO best practices to improve online visibility. The design focuses on clear calls-to-action and a trustworthy user experience to boost conversion rates for both loan applications and investments.

Can I manage the platform myself after launch?

Yes. We provide a comprehensive admin dashboard that allows you to manage users, monitor loan activity, approve applications, and update content without needing technical skills.

Can you redesign an existing P2P lending platform?

Yes, we can. Our team can analyze your current platform’s weaknesses and redesign it to improve user experience, security, and performance, helping you stay competitive in the fintech market.

Do you provide support after the platform goes live?

Yes, we offer ongoing support and maintenance packages. This ensures your P2P lending platform remains secure, up-to-date with regulations, and running smoothly for all users.

How much does a custom P2P lending website design cost?

The cost depends on the specific features you need, such as custom credit scoring algorithms, third-party integrations, and compliance requirements. Contact us for a detailed quote based on your project scope.

Do you ensure regulatory compliance in your designs?

While we are not a legal firm, our designs incorporate features that support compliance with financial regulations. We design clear user flows for KYC/AML processes and provide transparent information displays for loans and investments.