Expert Bank Website DevelopmentServices

We build secure, compliant, and user-friendly digital banking platforms. Our custom solutions for financial institutions enhance customer trust and drive digital transformation.

Trusted by banks and credit unions globally.

Introduction

From digital strategy to launch, we build banking websites that are secure, compliant, and user-centric.

Our fintech experts develop secure online banking platforms tailored to your institution’s needs. We ensure strict adherence to regulatory standards, implementing robust data encryption and secure user authentication to build trust and deliver a seamless digital banking experience for your customers.

Security

Compliance

Trust

Benefits

Why Choose Qrolic for Bank Website Development?

At Qrolic, we build websites for financial institutions that prioritize security, compliance, and customer trust. Here’s what sets our bank website development services apart:

Financial Industry Expertise

Our team has deep knowledge of the financial sector, building secure, compliant, and user-friendly bank websites that meet the needs of your institution and customers.

Seamless Digital Banking

We ensure your bank’s website delivers a flawless and intuitive online banking experience for customers across all devices, from desktops to smartphones.

Regulatory Compliance & Security

We integrate advanced security protocols and data encryption to build bank websites that are fully compliant with critical financial regulations like PCI DSS and GDPR.

Custom Financial Features

We develop tailored solutions like online loan applications, payment gateways, and secure customer portals that align with your bank’s product offerings.

Dedicated Maintenance & Support

Our team provides ongoing support and maintenance to ensure your bank’s digital platform remains secure, up-to-date, and performing optimally 24/7.

Scalable & Future-Proof

We build your bank’s website on a scalable framework, prepared for future growth and the seamless integration of emerging fintech tools and services.

Is Your Bank’s Website Meeting Customer Expectations?

Free Security & Compliance Review

Legacy systems? Security vulnerabilities? Poor user experience? We identify the compliance and tech gaps hindering your growth and build a secure, modern banking website.

Bank Website Development Process

Our Secure Bank Website Development Process

Our development process is designed for financial institutions, delivering secure, compliant, and user-friendly banking websites that build customer trust and drive digital engagement.

Comparison

Not All Bank Website Development Services Are Equal

Is your current bank website building customer trust and driving digital engagement, or is it a security risk?

Here’s where generic web developers fall short, and how Qrolic delivers a secure, compliant, user-centric solution.

Other Services

Without Qrolic :

- Uses generic templates lacking financial features

- Fails to meet security & compliance standards

- Poor integration with core banking systems

- Clunky user experience for online banking

- Weak security protocols and vulnerabilities

- Disregards ADA & WCAG accessibility needs

- Slow load times that erode customer trust

- No ongoing security monitoring or updates

Qrolic Technologies

With Qrolic :

- Custom design reflecting your bank’s brand & trust

- Built for regulatory compliance & airtight security

- Seamless integration with core banking & fintech APIs

- Intuitive UX for account management & services

- Robust, multi-layered security and encryption

- ADA & WCAG compliant for full accessibility

- Optimized performance for speed and reliability

- Dedicated support & ongoing platform maintenance

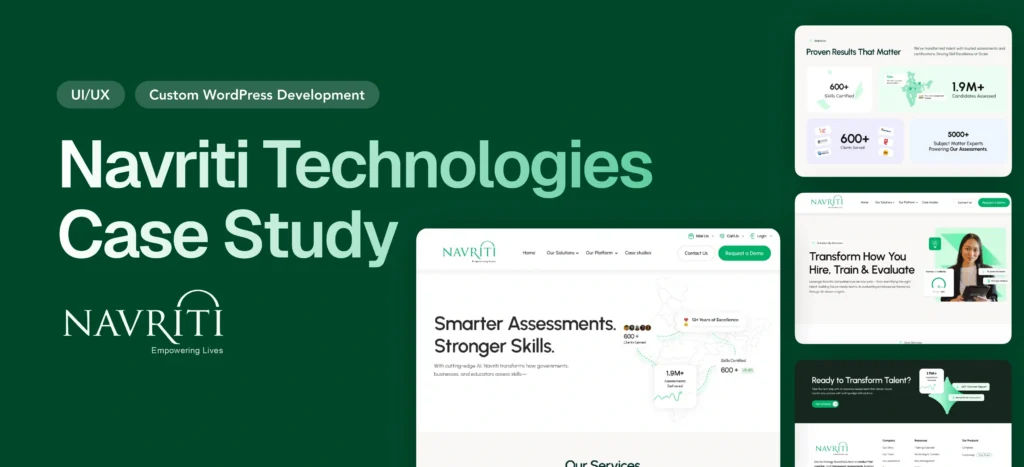

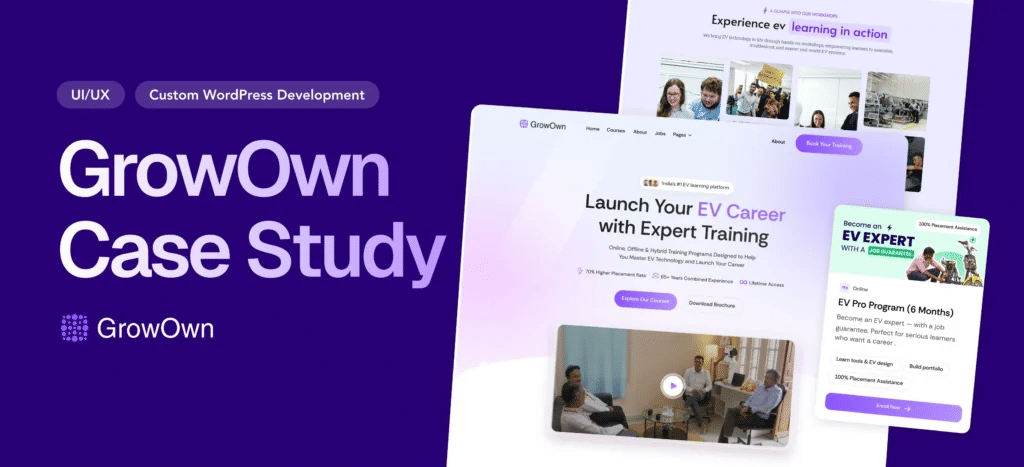

Case Studies

Proven Success in Financial Web Development

See how our specialized bank website solutions have enhanced security, streamlined online banking, and helped financial institutions build lasting customer trust online.

Why Qrolic

Partner with Qrolic for Secure & Compliant Bank Web Development

Our experts develop secure, compliant, and user-friendly digital banking platforms. We create custom solutions that meet stringent financial regulations, build customer trust, and drive digital engagement.

0+

Years of WordPress

Delivering top-tier digital services across design, development, and performance.

0+

Happy Clients

Serving global brands with a 95%+ satisfaction rate across industries.

0%

Client satisfaction

We’re committed to delivering solutions that truly make an impact.

0+

Team members

A strong team of experts in WordPress, web technologies, and UI/UX.

Planning a Digital Banking Platform?

Your Bank’s Reputation is Online – Let’s Build a Platform That Protects It

Request a free consultation and learn how our bank website development services can create a secure, compliant, and intuitive digital banking experience for your customers, fostering trust and growth.

Curious About the Cost? Free

Just drop your requirements on WhatsApp, and we’ll send you an instant estimate—no forms, no waiting.

Curious About the Cost? Free

Just drop your requirements on WhatsApp, and we’ll send you an instant estimate—no forms, no waiting.

Frequently Asked Questions

Bank Website Development FAQs

Our expert team builds secure, compliant, and user-friendly websites for banks and credit unions, focusing on digital banking solutions that build customer trust.

What services do you offer for bank website development?

We provide custom bank website design, secure online banking portal development, integration of loan and mortgage calculators, secure application forms, and ensuring full ADA and WCAG compliance for an accessible user experience.

How do you ensure our bank’s website will be secure?

Security is our top priority. We implement multi-layered security protocols, SSL encryption, secure hosting, and regular vulnerability scanning. Our development adheres to financial industry standards to protect sensitive customer data.

How long does it take to develop a new bank website?

A typical bank or credit union website takes 8-12 weeks, depending on feature complexity like core banking integration. We provide a detailed project timeline after our initial discovery and planning phase with your team.

Is ADA and WCAG compliance included in your development?

Absolutely. We build all financial websites to meet current ADA and WCAG 2.1 AA standards. Ensuring your website is accessible to all users is critical for legal compliance and providing an inclusive customer experience.

How do you handle SEO for a local or regional bank?

We implement a robust local SEO strategy during development. This includes optimizing for geographic keywords (e.g., ‘banks in [City Name]’), local business schema, and ensuring your branch locations are easy to find online.

Can our marketing team easily update rates and promotions?

Yes. We build on a user-friendly CMS that allows your team to effortlessly update interest rates, manage promotional banners, post news, and add blog content without needing any technical help from a developer.

Do you offer redesigns for existing credit union or bank websites?

Yes, we specialize in modernizing outdated financial websites. Our redesign process focuses on improving user experience (UX), enhancing security, ensuring mobile access, and upgrading your platform to meet modern digital banking needs.

What kind of ongoing support do you offer after launch?

We provide comprehensive support and maintenance plans tailored for financial institutions. This includes security audits, software updates, daily backups, and performance monitoring to ensure your site remains secure, fast, and reliable.

How much does a professional bank website cost?

Costs are based on the project scope, including custom features, third-party integrations, and compliance requirements. We provide a detailed, transparent proposal after understanding your specific goals. Contact us for a custom quote.

Can you integrate our site with third-party financial tools?

Yes. We have experience integrating bank websites with various third-party systems, including core banking platforms, appointment schedulers, live chat software, and financial data providers to create a seamless digital branch experience.