P2P Lending Platform Website Development Service

We build secure, compliant, and scalable P2P lending platforms. Our custom fintech solutions connect borrowers and lenders, facilitate seamless transactions, and drive growth.

Powering the next generation of fintech platforms.

Introduction

Connecting Borrowers & Lenders with a robust, custom-built platform.

Our fintech experts develop feature-rich P2P lending websites tailored to your business model. We integrate essential modules like loan origination, credit risk assessment, and automated repayment systems, ensuring a secure and user-friendly experience for all platform participants.

Security

Compliance

Scalability

Benefits

Why Choose Qrolic for P2P Lending Platform Development?

At Qrolic, we build P2P lending platforms focused on trust, security, and regulatory compliance. Here’s what sets our specialized development services apart:

Fintech Expertise

Our developers have deep expertise in fintech to build robust P2P lending platforms with secure loan management and payment gateway integrations.

Seamless User Experience

We ensure your P2P lending platform offers a seamless experience for both borrowers and lenders on any device, from desktops to smartphones.

Secure & Scalable Tech

We use advanced technologies and a scalable architecture to build secure, high-speed P2P lending platforms that can grow with your user base.

Custom P2P Solutions

We develop custom P2P lending solutions with features like unique interest rate models, risk assessment tools, and personalized user dashboards.

Ongoing Platform Support

Our team provides 24/7 support for your P2P platform, handling everything from technical issues to compliance updates and system maintenance.

Transparent ROI-Focused Pricing

We provide clear, cost-effective pricing for P2P platform development, focusing on delivering a strong return on your investment and business growth.

Ready to Launch Your P2P Lending Platform?

Free Platform Consultation

Regulatory hurdles? Security concerns? Struggling to connect borrowers and investors? Let us navigate the fintech complexities to build a secure, compliant, and scalable lending platform.

P2P Platform Development Process

Our Expert P2P Platform Development Process

Our development process is designed to deliver secure, compliant, and scalable P2P lending platforms—custom-built to connect investors and borrowers seamlessly.

Comparison

Not All P2P Lending Platform Builders Are Equal

Is your P2P lending idea held back by template solutions? Or is your existing platform struggling with compliance and scale? Here’s where generic builders fail, and how Qrolic’s specialized approach ensures success.

Other Services

Without Qrolic :

- Uses generic, off-the-shelf templates

- Inflexible architecture limits loan volume scalability

- Poor user experience for borrowers and lenders

- Lacks critical regulatory compliance features

- Complicated loan management and reporting tools

- Vulnerable security exposing sensitive financial data

- No integration with essential third-party APIs

- Limited support for platform updates and security

Qrolic Technologies

With Qrolic :

- Custom P2P platform built for your business model

- Scalable architecture to support growth in users

- Seamless UX for both investors and borrowers

- Built-in features for regulatory & AML compliance

- Intuitive dashboards for loan and user management

- Robust, multi-layer security to protect all data

- Secure payment gateway & third-party integrations

- Ongoing support for compliance and tech updates

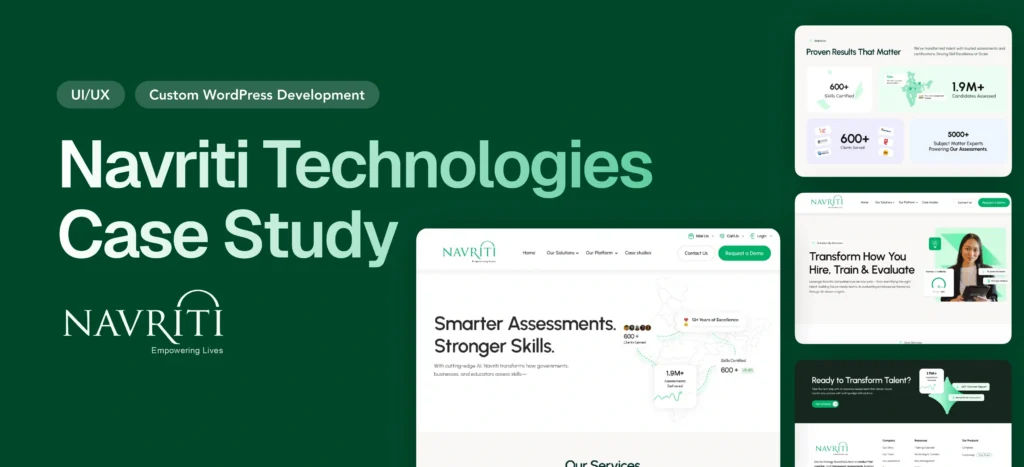

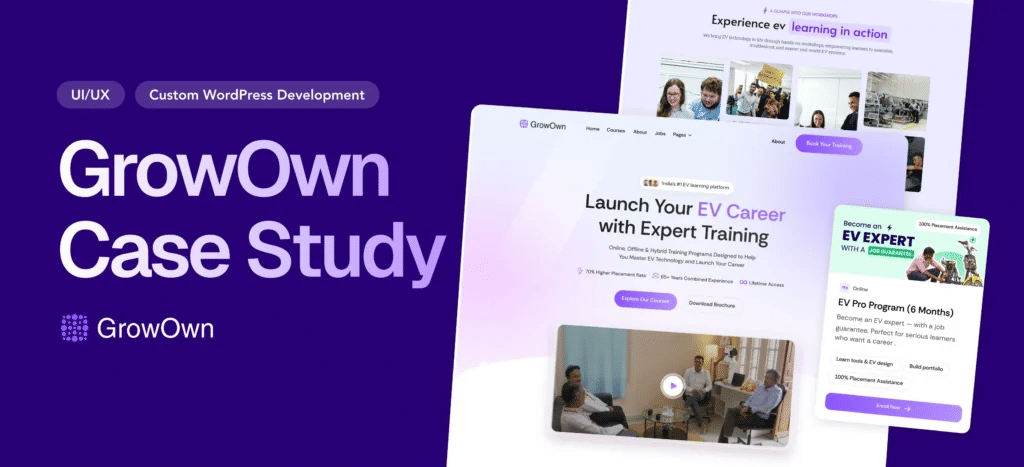

Case Studies

Proven Success in FinTech & P2P Development

Explore how our custom P2P lending platforms have launched successful fintech ventures, ensuring regulatory compliance, secure transactions, and scalable growth for our clients.

Why Qrolic

Partner with Qrolic for Secure P2P Lending Platforms

Our fintech experts build secure, compliant P2P lending platforms with robust features for loan origination, risk assessment, and investment management, delivering a seamless user experience.

0+

Years of WordPress

Delivering top-tier digital services across design, development, and performance.

0+

Happy Clients

Serving global brands with a 95%+ satisfaction rate across industries.

0%

Client satisfaction

We’re committed to delivering solutions that truly make an impact.

0+

Team members

A strong team of experts in WordPress, web technologies, and UI/UX.

Ready to Launch Your P2P Platform?

Your P2P Lending Platform Deserves Better – Let’s Build It Right

Get a free consultation and discover how our custom P2P platform development can deliver a secure, scalable, and compliant solution for borrowers and lenders, built for market growth.

Curious About the Cost? Free

Our P2P platform cost calculator uses real fintech

project data—no guesswork, just transparent pricing.

Curious About the Cost? Free

Our P2P platform cost calculator uses real fintech

project data—no guesswork, just transparent pricing.

Frequently Asked Questions

P2P Lending Platform Development FAQs

Our fintech experts build secure, compliant, and scalable P2P lending platforms that connect borrowers and investors, featuring robust loan management and automated workflows.

What is a P2P lending platform and what services do you offer?

We specialize in building custom peer-to-peer lending platforms that connect borrowers directly with investors. Our services cover full-cycle development, including UI/UX design, backend engineering, loan management systems, and payment gateway integration.

How do you ensure the security of a P2P lending platform?

Security is paramount. We implement multi-layered security including data encryption, SSL, secure payment gateways, and fraud detection. We also ensure compliance with financial regulations like KYC/AML to protect all user data and transactions.

How long does it take to develop a P2P lending website?

The timeline depends on the platform’s complexity, features like automated credit scoring, and integrations. A typical project can range from 3 to 9 months. We provide a detailed timeline after an initial discovery and planning phase.

Can you integrate third-party services like credit scoring and payment gateways?

Yes. We integrate with leading credit bureaus for automated credit scoring, KYC/AML verification services, and secure payment gateways like Stripe or Plaid to create a seamless and automated lending ecosystem on your platform.

Will the lending platform be scalable for future growth?

Absolutely. We build P2P lending platforms on scalable cloud architecture, ensuring your website can handle increased traffic, a growing volume of loan applications, and a larger investor base without compromising performance or speed.

What are the essential features for a P2P lending platform?

Key features include separate dashboards for borrowers and investors, a loan application and management system, automated credit scoring, secure payment processing, detailed reporting, and a robust admin panel for platform management.

Can I manage loan listings and user accounts from a backend?

Yes. We develop a comprehensive admin dashboard that gives you full control over user management, loan approvals, interest rate settings, transaction monitoring, and content updates, allowing you to manage your platform operations efficiently.

How do you ensure regulatory compliance for a fintech platform?

We build platforms with regulatory frameworks in mind, incorporating features for KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, data privacy compliance (like GDPR), and transparent reporting to meet financial authority requirements.

How much does a custom P2P lending platform cost?

The cost depends on the project scope, feature complexity, and technology stack. We offer tailored quotes for everything from an MVP to an enterprise-grade platform. Contact us for a detailed proposal and transparent cost breakdown.

Do you provide support and maintenance after launch?

Yes, we offer ongoing support and maintenance packages. These services include regular security audits, software updates, performance optimization, and technical support to ensure your P2P lending platform remains secure and efficient.